income tax calculator indonesia

This field is adjusted toward your status Eg. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs.

How To Calculate Income Tax In Excel

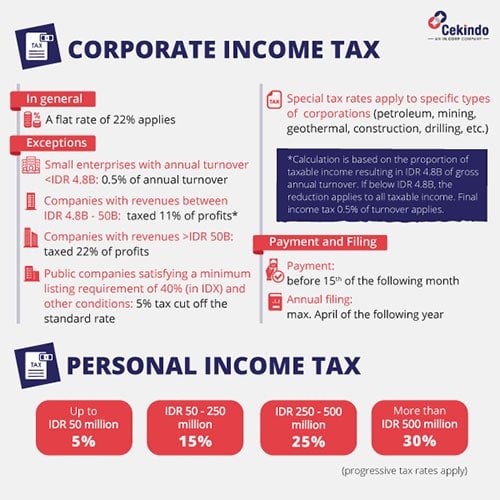

4 rows The Tax tables below include the tax rates thresholds and allowances included in the.

. The personal income taxpayer can be a resident or a non-resident of Indonesia. Last reviewed - 30 December 2021. Taxpayers can extend the period of submission of the annual income tax return for 2 two months at the maximum by submitting notification to the ITA.

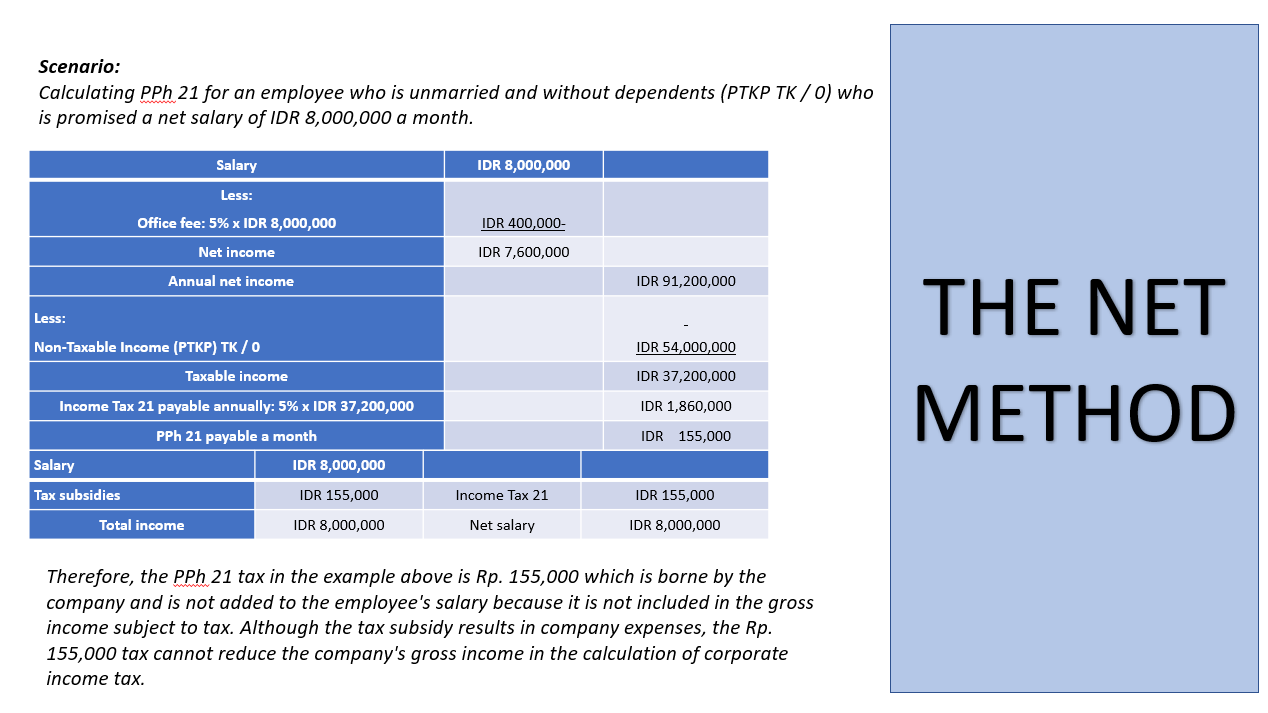

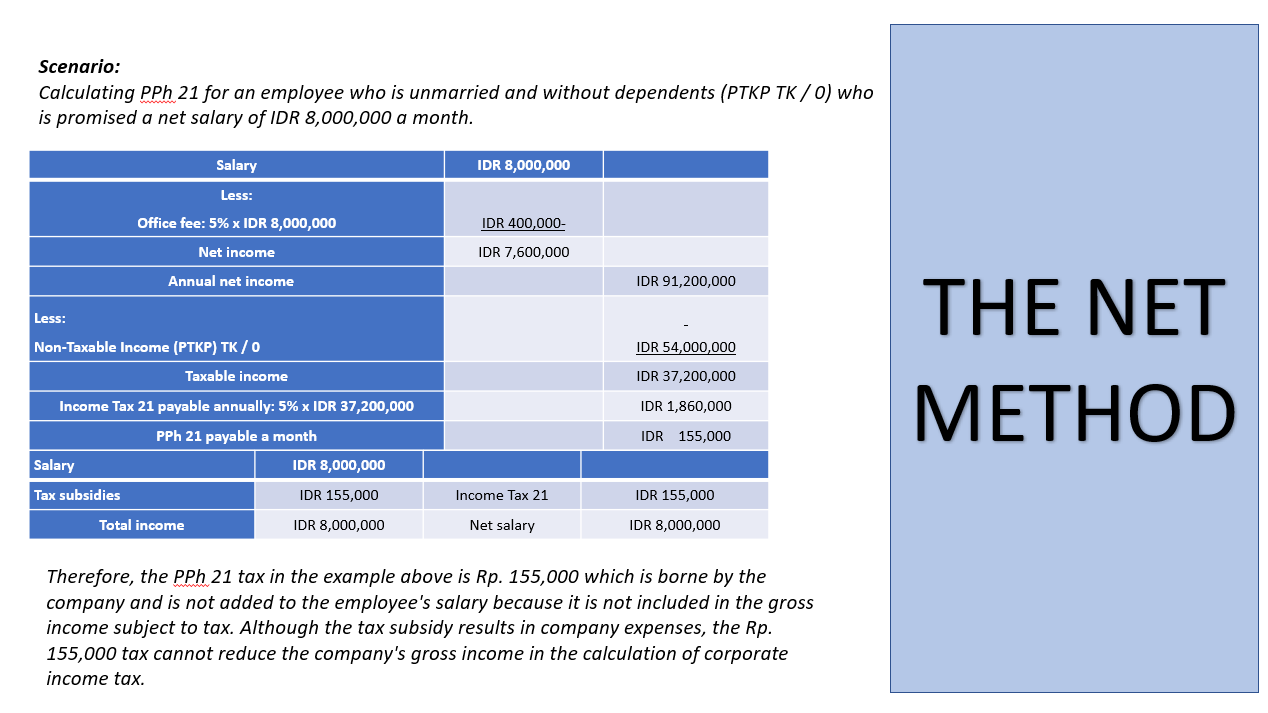

Personal income tax in Indonesia is determined through a self-assessment system meaning resident tax payers need to file individual income tax returns. Indonesian residents qualify for personal tax relief as seen in the table below. Given the consequences of non-compliance foreign workers should seek help from registered local.

To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. In Indonesia tax services are provided by Deloitte Touche Solutions. PPh 26 Income Tax is taxed at a flat rate of 20.

2 1 8939700 178794. Point 13 multiplied by 12. Youll then get your estimated take home pay a detailed breakdown of your potential tax liability and a quick summary down here so you can have a better idea of what to expect when planning your budget.

Generally the VAT rate is 10 percent in Indonesia. In Indonesia a general flat rate of 25 applies becoming 22 in 2020. However if your company is a public company that satisfy the minimum listing requirement of 40 in Indonesia Stock Exchange IDX and.

If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000. Individual - Taxes on personal income. Resident tax payers are subject to progressive tax rates ranging from 5 percent to 30 percent.

Certain types of income earned by resident taxpayers or Indonesian PEs are subject to final income tax. Personal Income Tax Rate Rp An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above. There is a wide variety of taxes in Indonesia that companies investors and individuals need to comply with.

VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent. 2880000 wife 2880000 and up to three children Rp. This includes corporate income tax personal income tax withholding taxes international tax agreements value-added tax VAT and many more.

Thus resident taxpayers have to calculate and settle ie if the Annual Individual Income Tax Return AIITR is showing underpayment amount and submit for the AIITR accordingly. Indonesia - utilizes the self-assessment method for individuals to calculate settle and report income tax. This calculator uses IDR Indonesian Rupiah.

2 x 600000000 12000000 Personal allowances 54000000 3 x 4500000 67500000 Pension contribution. Taxable income in Indonesia. Such a payment is referred to as Article 29 income tax.

Apakah Anda memiliki NPWP Bagian ini diisi dengan NPWP sesuai dengan yang tercantum pada Kartu Nomor Pokok Wajib Pajak Kartu NPWP. As of 2016iii the non-taxable income threshold is IDR 54000000 per year for single individuals and IDR 58500000 per year for married individuals. The Indonesia Tax Calculator is a diverse tool and we may refer to it as the Indonesia wage calculator salary calculator or Indonesia salary after tax calculator it is however the same calculator there are.

Resident taxpayers must file personal income tax returns through a self-assessment system and are subject to tax rates of 5 to 30. If you need to convert another. In this respect the tax withheld by third parties referred to as Article 42 income tax constitutes the final settlement of the income tax for that particular income refer to pages.

Annual PPh 21 Tax. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for. Indonesian tax resident and non-resident taxpayers who have Tax Identification Numbers Tax-ID are generally taxed on a.

Bagi penerima penghasilan yang dipotong PPh Pasal 21 yang tidak memiliki NPWP dikenakan PPh Pasal 21 dengan tarif lebih tinggi 20 daripada tarif yang diterapkan terhadap wajib pajak yang. Enter your salary into the calculator above to find out how taxes in Indonesia affect your income. The tax authorities have the right to audit any tax return to ensure the individual has correctly calculated the tax payable within the 5-year statute of limitations.

Deductions for an individual are Rp. A quick and efficient way to compare salaries in Indonesia review income tax deductions for income in Indonesia and estimate your tax returns for your Salary in Indonesia. However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation.

TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate. Income tax in Indonesia can range from 5 to 30 percent and you need to be sure you are placed in the correct tax brackets. Except for self-assessed VAT on utilization of intangible taxable goods andor.

Corporate Income Tax Rate. If you are a contractor and want a calculation on your tax and net retention in Indonesia we can supply it to you free of charge. Annual Tax Exempt Income.

Non-residents are subject to a 20 withholding tax on any income sourced within Indonesia. If you make 0 a year living in Indonesia we estimate that youll be taxed 0. Indonesia adopts a self-assessment system.

How to calculate the total cost of import in Indonesia. This is an income tax calculator for Indonesia. Calculate Employee Income Tax in Indonesia.

However the new Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax. Indonesian Tax Guide 2019-2020 9 3. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations.

Non-taxable Incomes and Reliefs. This means 19 for the fiscal year of 202021 and 17 for the fiscal year 2022 onwards. Occupational expenses 5 from gross income or maximum 6000000 6000000 Old age saving contribution paid by employee.

For public companies that have a minimum listing requirement of 40 and fulfil other conditions they are granted a tax discount of 3 off the standard rate. The calculator only includes the individual tax-free allowance of IDR 24300000. Total Annual Net Income.

Annual gross income.

Download Income Tax Calculator Free Pc Ccm

Taxation System In Indonesia Your Guide To Income Taxation

Personal Income Tax Calculator In Indonesia Free Cekindo

How To Calculate Income Tax In Excel

Taxation System In Indonesia Your Guide To Income Taxation

Indonesia Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

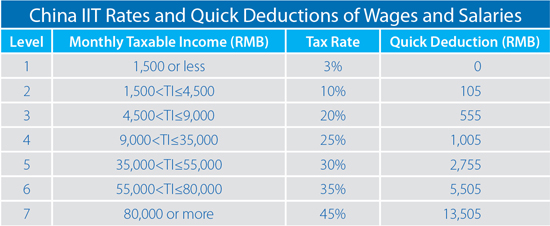

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Indonesia Salary Calculator 2022 23

Cukai Pendapatan How To File Income Tax In Malaysia

How To Calculate Foreigner S Income Tax In China China Admissions

Personal Income Tax Pit In Indonesia Acclime Indonesia

Indonesia Payroll And Tax Guide

Singapore Income Tax Calculator Corporateguide Singapore

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide

![]()

Indonesia Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Personal And Corporate Income Tax Indonesia How To Calculate It